You likely know that offering contract staffing services can help you grow your recruiting business. But, do you know what laws to follow? When you work with contractors who are employed through you as W-2 employees, you need to be mindful of their contract workers’ rights.

If you offer contract staffing services, you are the worker’s W-2 employer of record (unless you use a contract staffing back-office solution).

As the contractor’s employer, you are responsible for payroll, withholding state and federal taxes and deductions, workers’ compensation coverage and complying with employment laws.

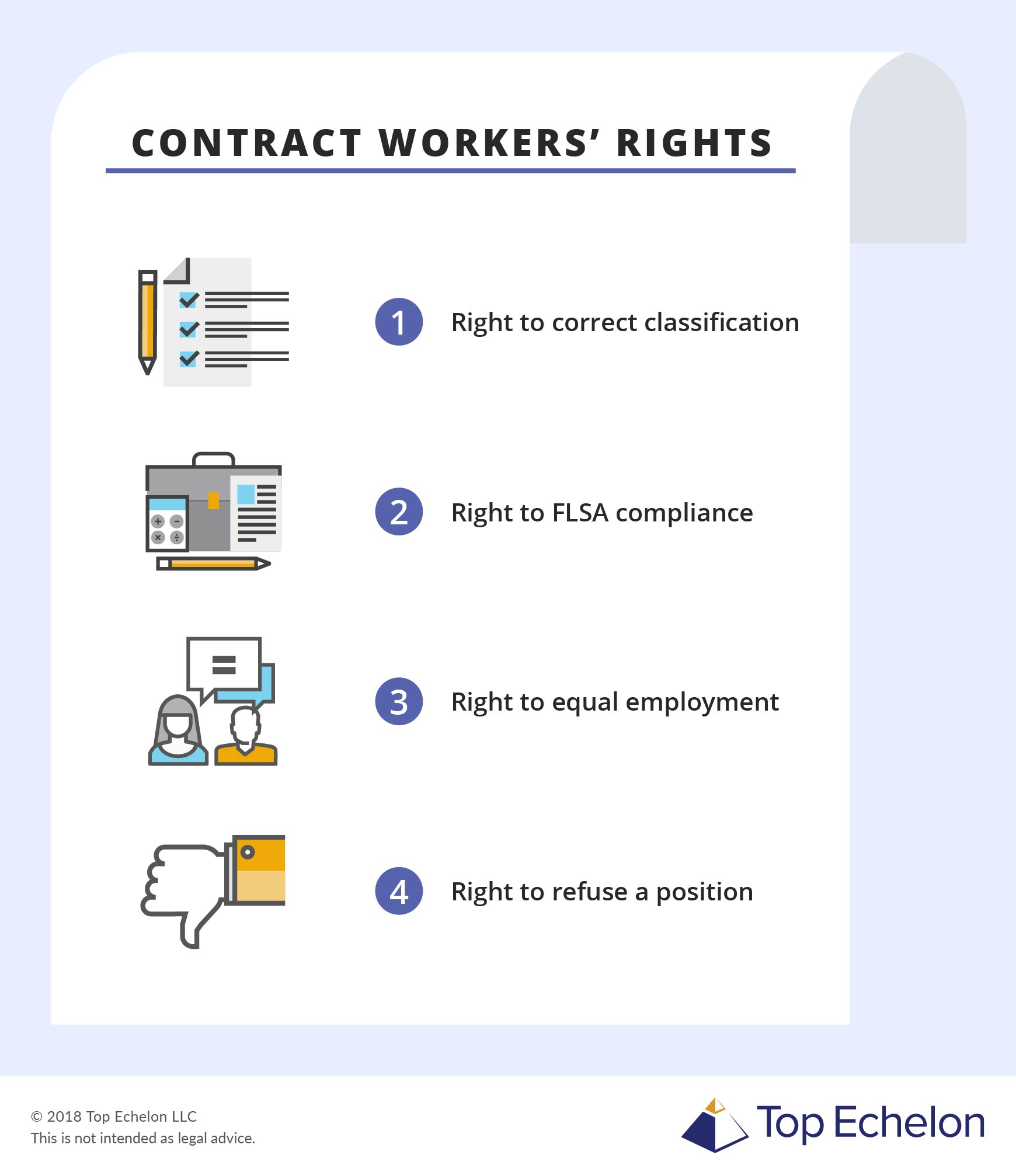

So, what are your contract workers’ rights?

There are a few ways you can misclassify workers. You can label a worker as an independent contractor when they are W-2 employees. Or, you can classify an W-2 employee as exempt when they are nonexempt.

Some businesses misclassify workers as independent contractors to avoid handling taxes such as federal income tax, state and local income taxes (if applicable), and Social Security and Medicare taxes (FICA). Plus, employers need to sign up for workers’ compensation insurance, and offer ACA compliant benefits (based on business size).

Misclassifying employees as independent contractors can lead to hefty fines and penalties. The IRS offers a variety of website tools to help you avoid accidentally misclassifying your worker. In fact, they even offer a “Determination of Worker Status” form if you want a formal ruling on your specific situation (Form SS-8).

If you determine that your contract worker is an employee and not an independent contractor, you must further classify their employee status. Employees are either exempt or nonexempt.

Exempt employees are exempt from minimum wage and overtime requirements. To be exempt, an employee must meet three requirements:

If your contract worker doesn’t meet the above requirements, they are considered nonexempt. Nonexempt employees are entitled to overtime and minimum wage laws.

As an employer, you must follow the Fair Labor Standards Act (FLSA) when processing payroll and maintaining records.

The FLSA enforces minimum wage, overtime, hours worked, recordkeeping, and child labor laws.

Complying with minimum wage and child labor laws shouldn’t be an issue with contract staffing. But you must pay your contractors at least the federal or state minimum wage, whichever is higher. And to follow child labor laws, don’t employ minors to work hazardous jobs and understand other Department of Labor restrictions.

Do contractors get overtime? Again, if the employee is exempt, you don’t need to worry about providing overtime wages. However, if the employee is nonexempt, you must offer overtime pay for hours worked over 40 in one workweek.

Lastly, you must follow recordkeeping requirements. Retain records such as the employee’s name and Social Security number, hours worked at your client’s company per day and week, pay rate, and payroll deductions. Under the FLSA, employers are required to keep employee-related records for nonexempt employees for at least three years.

Your client probably has an idea of the type of contractor they want working at their business. However, their description of their ideal worker cannot be discriminatory.

As the contractor’s W-2 employer, you must follow laws set by the U.S. Equal Employment Opportunity Commission (EEOC). The EEOC protects employees against discrimination due to their race, color, religion, sex, national origin, age, disability, or genetic information.

W-2 contract workers’ rights include protecting them from the above types of discrimination. As the recruiter and provider of contract staffing services, you cannot agree to discriminatory requests from your client, like wanting a worker under the age of 40 (i.e., age discrimination in hiring).

Some contract positions may turn into direct hires, which are instances when your client extends a job offer to the worker following their contract. However, contract workers are not obligated to accept a full-time offer.

Your contract workers have the right to refuse a position with your client’s company. Your client must formally extend a job offer to them if they want to convert contractor to employee.

As more and more companies continue to add W-2 contract workers to their normal workforce, it is important to remember that these workers ultimately have the same rights as other employees (direct hire employees), except you (or your back-office) are their legal W-2 employer of record. And, you also need to follow all state and federal laws.